This post started as an email that got way too long. I added some charts and put it up here:

The rally has not surprised me (on March 31 I expressed the opinion that we would hit 900 or higher by summer:

…more likely in my mind is a protracted rally extending to 900 or higher by summer, then rolling over to meet a date with 400 next winter. Look at last year’s rallies from March to May and July to August for an idea of what this might look like, though on a larger percentage and time scale because we are correcting a larger sell-off. The case for such a move is bolstered when you hear major investment banks’ strategists calling this a dead cat bounce. Too many people are still afraid to call a bottom, and they need to be suckered into long positions before this is over (along the same lines, too many traders are embracing the dead cat bounce and need to be shaken out before it can get back to leading the buy-and-holders to slaughter).

That said, I was leaning closer towards 900 than 1050:

I am highly skeptical, though respectful, of calls for a the mother of all bear market rallies. Robert Prechter and some other Elliott Wavers, as well as Tim Knight (slopeofhope.com) seem to be anticipating a 6-month or longer rally to as high as 1050. I simply don’t see why that is necessary in this environment. This is a depression, and the last one was accompanied by bear market that, after the first 6 months, maintained the momentum of a cruising supertanker. Rallies of 20 percent and 2 months were about all you got from April 1930 to July 1932 as the Dow dropped from about 295 to 41. That deflation-driven event was a much more orderly bear market than the jagged trajectory of the dot-com crash, which occured while the credit bubble continued to expand. Interestingly, the 1966-1982 secular bear (a brutal 75% loss in real terms) also traced out such a series of steep plunges and rallies as the bubble kept inflating thanks to a compliant Fed and the abandonment of the last trace of the gold standard. Employment was down, but animal spirits were still running high with the computing boom, the advent of securitization, and new innovations in consumer credit.

Though I saw this rally coming a mile away, I have traded it very poorly. First, I put too much emphasis on picking the absolute bottom for a buy-in. Back in Feb and March I got out of most of my shorts by the time we were under 700, and I entered a bunch of limit orders to put over 1/2 of my net worth in SPY on the long side. Unfortunately, those orders started at 620, and we bottomed at 666. So I missed the bounce, and not only that, starting in April I began to short the junk stocks that were flying the highest and have been the real driver of this market. That was way too soon, and they kept on going, to the surprise of many a long-short fund as well. The outperformance of junk was a surprise, but the overall bounce has not been. When you have mood as compressed as it was back in March and you reach an exhaustion point after 18 months of a strong bear trend, you get a big reversal, which can then generate the extremes of optimism needed to set up the next plunge.

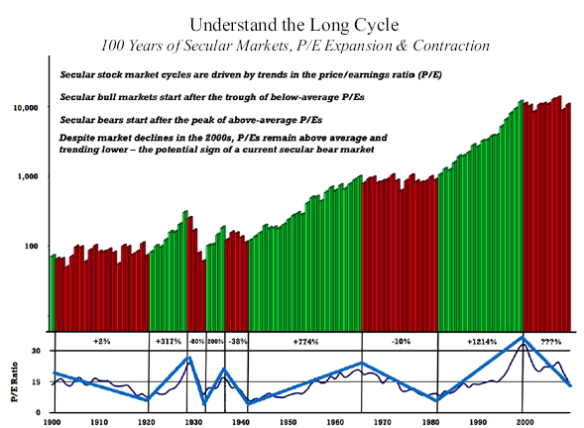

I’ve been buying long-term puts on the S&P and Nasdaq again since late March (way too soon, considering that I expected the rally to continue). I bought a bunch more yesterday, by the way. I view it as extremely unlikely that this market doesn’t decline to the point where solid value offers support — that would be a sub-10 PE and dividend yield of over 5% on dividends that have to fall by 50% or more from here to around $12 for the S&P. That would be the 240 level, but it should take at least a couple more years to get there (or below), if not four or five.

What has always worried me as a short in this market is not a 5-8 month rally, but a 12-18 month affair like some of those that Japan has experienced in its long bear market since 1989:

Source: Yahoo! finance

That said, Japan’s financial sector was deflating while exports were improving, families had savings and the rest of the world was growing. Today’s situation is much, much more severe of course, and we can only find a parallel in the Great Depression for so many of the economic trends we are seeing. The longest bounce in that bear market was 5 months, and it was of similar magnitude (48% from Nov. ’29 to April ’30; we’re up 47% in the 4.5 months since March 6).

This is the Dow from 1928 to 1931:

Source: Yahoo! finance

And here’s how that bounce looked from 1933:

Source: Yahoo! finance

The S&P500 is now the most overvalued in history by PE (infinite as of this quarter’s running 12 month total, or a dot-com-esque 32 times current annualized earnings levels, about $7.50 per quarter). The dividend yield is about 2.5%, but dividends are nearly as high as earnings right now, which is completely unsustainable (they should be less than half of earnings). On a sustainable basis, the yield is 1.0 – 1.25%.

Here is the S&P PE ratio (TTM data through 12.31.08) going back to 1936. (the dates read right to left, since I can’t figure out how to reverse them in Excel). Data through 6.30.09 would be off the chart:

Real (U-6) unemployment is approaching 17% and climbing, and that is if you exclude the likely 6 million illegal immigrants who are out of work now (who used to take home $100 per day as construction cleanup boys or dishwashers). Throw them in, as we would have in the 1930s, and you get a solidly depressionary 20%.

Credit is still being withdrawn everywhere you look, whether in home equity, credit cards or small business loans. There has been a bounce in the corporate bond market, but that is due to the same technical forces that are driving the stock market, and the big bankruptcies are just beginning. Only the very weakest have gone under so far, like the car companies.

So with this backdrop, I don’t expect this summer’s good feelings to last into the holidays. The markets should start to roll over again soon, since the big-money value investors needed for a sustained advance can find no reason to buy in, and the little guy has been burned too many times to chase this market very far. Volume is very thin, and an unusually large fraction of trading is taking place between automated programs.

When the data to back up the green shoots theory fails to show up after another few weeks or months, and even official unemployment is solidly into the double digits and climbing, while another huge wave of mortgage resets hits the middle class, there will be no hope at all left to support this market, and it will slide to levels not seen since George Bush Sr. was in office.

It will then still not be a safe long-term buy. For that, considering all of the obstacles that the government has created to profit-making, we need to get back to Reagan-era levels, somewhere under the bottom of the 1987 crash.

S&P500:

Source: Google finance